The best investment strategy: discipline

Lo and behold the first two weeks of 2022 are testing the “best investment strategy” of 2022 as articulated by Jason Zweig from the WSJ and quoted by us last week. Buying the dips because stocks will bounce back has not worked so far. That might change tomorrow but so far “don’t fight the Fed” is dominating market action. Markets decline faster than they go up and, sure enough, market averages are facing sharp declines almost daily since the beginning of the year. More so for the Nasdaq index which has outperformed other major indexes over the last 3 years.

It has been shown repeatedly through research in behavioral finance that the pain of loss is twice as great as the satisfaction of gains. Investors are used to 15-20% annual gains on a portfolio of 60% stocks and 40% fixed income and probably did not appreciate how out of the historical averages this recent return was. The wealth effect was important in combatting the last recession of 1 month. Government fiscal intervention put money in Americans' pockets and bank accounts. Savings rates reached recent highs during the first year of Covid. That contributed to huge GDP growth rates in the 2nd and 3rd quarters of 2021. The massive fiscal stimulus also partially contributed to a large increase in inflation.

Turning a battleship inside a bathtub is tough. It is impossible to find a perfect balance in such a massive economy. On many levels, the Federal government was successful in keeping cash flowing into households, and then, as restrictions eased, that cash flowed into the economy. Unintended consequences were inevitable. The supply chain backlog and the rapid increase in inflation are examples.

Common wisdom says that January is a good month for stocks as new money is invested in retirement accounts, and money managers, having sold in December to capture gains or losses, are reinvesting those funds in January. A quote from Yahoo finance reporting JP Morgan analysis for January 2022:

This month, JPMorgan expects high-beta stocks with more volatility than the S&P 500 to outperform the market.

The bank’s analysts say high-beta stocks entered an “outright bear market” in 2021. That’s not because of a lack of value; investors have been selling them off in favor of stocks that offer lower volatility.

The low demand/high upside dynamic means “the January effect” could “be even more pronounced this time around” for high-beta stocks, according to JPMorgan analysts.

So much for prognosticators, as the 3 stocks recommended are down this year by 10% to 25%. Yet again shedding light on why market timing is problematic. Being accurate with forward-looking predictions over the short term is a roll of the dice. The best we can hope for is the analysis that gives us a historical expectation over 10 years.

Recently, Morningstar, the research and portfolio reporting service we use, lowered its safe withdrawal rate for retirees from 4% to 3.3%. Morningstar’s reasoning: with asset values at historical highs, it is more likely that returns will be more modest going forward for the next ten or more years. Link to Morningstar report "The State of Retirement Income: Safe Withdrawal Rates."

RMD Changes for 2022

Speaking of withdrawal rates, here is a link to an article explaining the latest changes for RMDs, which are now based on longer lifespans. This means annual required minimum distributions are slightly less than the earlier formulas that were used.

SAS Investment Management Clients: 2021 Form 1099 Anticipated Delivery Schedule

TD Ameritrade would like to keep you informed as to the estimated availability dates for the tax year 2021 tax forms.

To help make sure SAS Financial Advisors' clients receive their tax documents as soon as they are available, clients are encouraged to sign up for electronic tax form delivery. Clients can sign up for e-delivery of tax documents by logging into www.advisorclient.com, then clicking My Profile > Communication Preferences.

Clients can find the tax documents on advisorclient.com by simply clicking the appropriate document on the Statements & Tax Documents menu.

Listed below is useful information pertaining to the anticipated dates that 2021 Consolidated Form 1099s will be available to be viewed online.

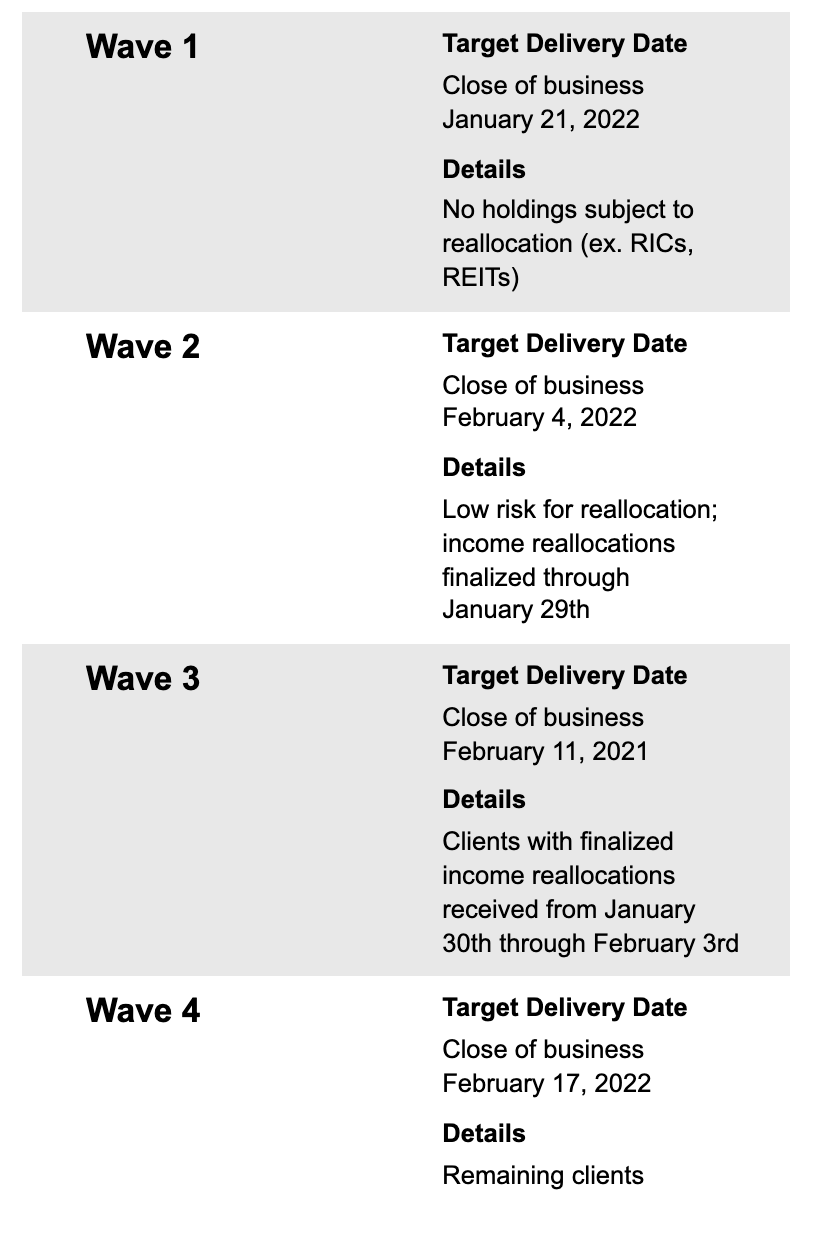

■Delivery of 1099s: Currently, we expect the first wave of 1099s to begin posting online on January 21, 2022, with Advisor and client notifications going out shortly after. The estimated dates for the waves are below:

■Correction Cycles – Begins March 3, 2022, and occurs every 2 weeks through April 14, 2022

All dates are estimates and subject to change

■1099 Notification: Once these 1099s have been posted online, advisors will be notified that they are available. Clients that have enrolled to receive their 1099's online, will also receive an e-mail notification.

■For clients receiving paper documents, they should allow several days for mail delivery after these forms have been posted online.

To balance clients’ desire to receive their documents earlier and with an effort to minimize the chance that a client would receive a corrected Form 1099 (potentially requiring the refiling of tax returns), clients may be excluded from the first four waves for the following reasons:

■A client held securities such as mutual funds, Unit Investment Trusts (UITs), or Real Estate Investment Trusts (REITs), which may reallocate payments (for example, from long-term capital gains to short-term capital gains) in January and beyond.

■A client held an investment instrument that is considered to be a Widely Held Fixed Investment Trust (WHFIT), such as a Commodity Trust or Royalty Trust, where there is a possibility of additional information being provided by the company.

This website is informational only and does not constitute investment advice or a solicitation. Investments and investment strategies recommended in this blog may not be suitable for all investors. SAS Financial Advisors, LLC and its members may hold positions in the securities mentioned within this newsletter.

The SAS Newsletters are posted on the SAS Blog weekly: https://www.sasadvisors.com/blog